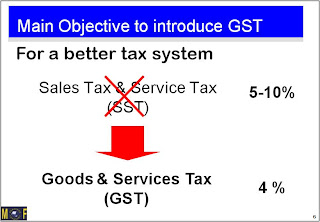

The introduction of GST in Malaysia at this initial stage is not meant for revenue but the most important thing is to put the system in place first so that all the inherent witnesses under the current tax system could be address. However, experience of other countries show that GST will enhance tax compliance and this will eventually lead to a higher revenue collection to the government.

Strategy

Just to get a revenue neutral and Cabinet decided to fix the GST rate at 4%

Strategy

Just to get a revenue neutral and Cabinet decided to fix the GST rate at 4%

Reasons:

the Government does not want to burden the people with high GST rate

To minimise the GST impact on the price of goods and services especially on goods and services which is consumed by the lower income group.

With GST rate of 4%, the CPI impact is - 0.1%

0 comments:

Post a Comment